Best Business Debt Consolidation Companies

Some of the best companies for business consolidation loans, and what factors they're judged on.

In the complex landscape of business finance, debt control has a much broader meaning than mere sustainability and growth. Business debt consolidation is one such strategic approach toward streamlining financial obligations, cutting costs, and improvement in cash flow management. Let's try to understand what exactly business debt consolidation is, its strategies, its benefits, its considerations, and steps for practical implementation along with real-world applications across different industries.

It is simply a process whereby more than one debt will be consolidated to one manageable account by the lender. It bundles several financial instruments that include loans, credit lines, and outstanding credit card debt. The goals at this level are two-fold: resolve the problem of multiple payments and still ease the burden by attaining lower interest, longer periods, or both.

1. Simplification of Financial Management: This means consolidating everything into one monthly payment, not into several at interest rates of varying degrees. This results in less administrative hassle involved.

2. Cost Reduction: Lower interest rates are offered to a business through consolidation. It entails saving money in the course of repayment that may turn out to be very beneficial in improving profitability and financial health.

3. Enhanced Liquidity: By spreading out the principal with grace periods or making the monthly installments smaller, debt restructuring makes more cash flow available that the business can effectively utilize in running its operations, new investments, or plans for growth.

Some of the debt consolidation strategies used by businesses to handle their Financial Situations and Goals are as follows:

1. Debt Consolidation Loans: This means taking a new loan to help repay other outstanding debts. The new loan is usually more favorable than the one it is substituting; it may have a lower interest rate or longer payoff period than that of the original debt.

2. Business Lines of Credit: This is a revolving line of credit used for refinancing high-interest-rate debt, providing flexibility in borrowing and repayment associated with running a business.

3. Balance Transfer Credit Cards: Some businesses would want to transfer high-interest credit card debt to a new credit card at an introductory interest rate, which is more efficient in reducing interest expenses.

4. Asset-Based Loans: Businesses that have quality assets—such as equipment or property—may decide to use those assets as security/collateral and help lock in better terms for a debt consolidation loan.

5. Debt Management Plans: Negotiation with the lender involving either interest rates or easier conditions of repayment through financial advisors/consultants.

Every consolidation strategy has benefits and considerations that must be appropriately weighted in respect to the credit profile, current debt structure, and the long-term goals of the business entity.

Business debt consolidation has a number of benefits to help with financial stability and operational efficiency:

1. Reduced Interest Rates: Consolidating loans will allow the firm to secure a considerable interest rate, minimizing long-term interest expenses related to debt.

2. Better Credit Rating: A business can utilize debt consolidation in handling debt obligations better, which improves the score rating of the business. This means easier access to better terms for financing in the future.

3. Easy Financial Management: The business will then be able to roll over its debt into one monthly payment, which is easier to plan for financially and administratively.

4. Longer Repayment Duration: One of the most prevalent features associated with consolidation is that it provides for a longer repayment duration; this immediately relieves pressure on the company in the short term while offering leeway regarding its cash flow management.

5. Better Flexibility: Financial burdens associated with debt will be reduced, and a business will be better placed to spend its money on strategic activities like growth, research and development, or market expansion.

While there are some very good arguments for business debt consolidation, there are a number of factors to consider:

1. Costs and Fees: Consider origination fees and closing costs of new loans or credit cards, and prepayment penalties for existing debts.

2. Impact on Credit Profile: Consolidation can have short-term pitfalls for a business in the regard to its credit profile because of new inquiries or the closure of accounts. These are short-run effects restricted only by good debt management and being open to long-term benefits.

3. Financial Discipline: Debt consolidation does not clear debts but restrains them for easy repayment. It is, therefore, upon the business to ensure that it does not accumulate new debt and sustains financial discipline tocontinue enjoying the consolidated debt benefits.

4. Risk Management: Consider the risks that comes with some of the consolidation options. These may be attached to collateralized loans or personal guarantees, working toward a balance in risk management with financial stability is crucial.

5. Long-term Financial Strategy: Consolidation efforts should dovetail into a larger context of business financial goals and growth plans; indeed, consider how restructuring debt supports growth in business and resiliency in dynamic market conditions over the long-run.

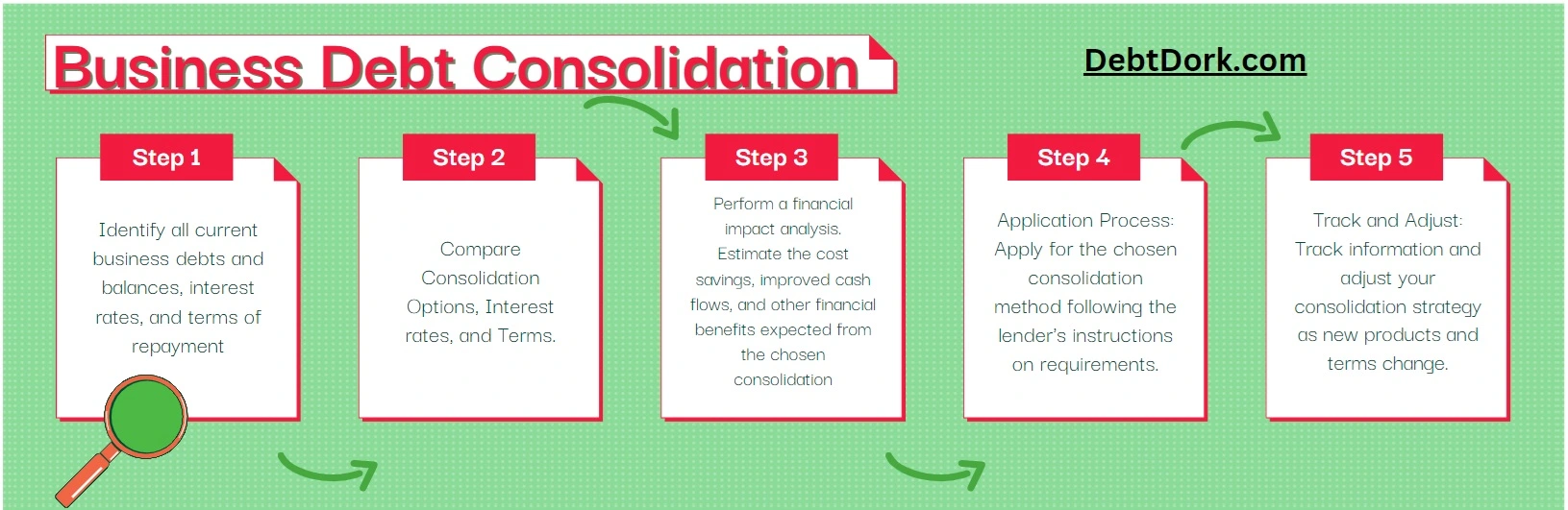

Taking due care for adequate measures of implementation, an effective consolidation of a business must be properly planned and put into operation by these steps:

1. Identify Current Debt Obligations: Make sure that a record is created for all existing debts, which clearly states the balance, interest rate, and terms of repayment.

2. Comparison of Consolidation Options: The interest rates, repayment terms, fees, and any other criteria which can potentially help with cost-cutting would have to be scrutinized among various consolidation options.

3. Financial Impact Analysis: Use financial tools or advisors to estimate the cost savings, improved cash flows, and other financial benefits expected from the chosen consolidation.

4. Apply for a Consolidation Loan: Apply for the chosen consolidation method following the lender's instructions on requirements and documentation.

5. Tracking and Adaptation: Periodic reviewing of consolidated Statements of Finance and Performance Metrics and implement proper adjustments to your strategies relating to debt management and also understand new opportunities which could be implemented in a short amount of time.

Now, let us look at a hypothetical real-world application. For instance, a retail chain consolidated numerous high-interest loans into one lower-rate loan. By doing so, it saved substantially on interest payments annually. Another example involves a technology startup whereby a credit card balance transfer solved the issue by consolidating credit card debt in order to reduce monthly payments and increase the liquidity for product developments and market expansion initiatives.

Business debt consolidation is a strategic tool that helps businesses rationalize debt management costs, lower them, and add flexibility to their finances. It can require informed decisions to ensure the long-term health of a business with financial fitness, operational efficiency, and sustainable growth. Considering the strategies, benefits, considerations, and steps in implementing such a financial tool are part of the process. Careful planning coupled with financial discipline, may result in optimizing cash flow, improving credit ratings, and other strategic benefits. When looking at new business opportunities and challenging economic conditions, an effective debt consolidation can help with resilience, competitiveness, and profitability in the global marketplace.

The SBA provides extensive resources and guidance on various aspects of business finance, including debt consolidation. Their website offers articles, guides, and tools to help small businesses understand the process of debt consolidation and make informed decisions.

Website: SBA Debt Consolidation Loans and Options

SCORE is a nonprofit organization dedicated to helping small businesses through mentoring and education. They offer resources on debt management and consolidation, providing insights into different strategies and considerations for businesses of all sizes.

Website: SCORE Business Debt Consolidation Resources

NFIB is a leading advocacy organization for small and independent businesses. They provide resources and articles on financial management, including debt consolidation strategies tailored to the needs of small business owners.

Website: NFIB Debt Consolidation Information

Some of the best companies for business consolidation loans, and what factors they're judged on.

There are many considerations when choosing a business consolidation loan. We go through a few factors you should take into account.