Business Debt Management

Within the competitive atmosphere of the modern business, the issue of effective debt management appears to be very relevant to the sake of financial well-being and viability of any business. We get dorky and discuss some issues of business debt: types of debt, strategies on how to manage one's debt, steps to be taken to reduce the burden of debt, options in bankruptcy, and some useful online resources dedicated to the financially troubled business.

Understanding Business Debt

Business debt is the amount of money that the business owes at any particular time to its creditors, suppliers, or financial institutions. It can string from loans, lines of credit, trade credit, or leases. Not all business debts are created equal. Knowing the sub-forms of business debt sheds a light on the underlying basis for a proper debt management plan.

Types of Business Debt

Secured vs. Unsecured Debt:

This, in most cases, goes with comparatively lower interest rates associated with it because debt is secured with some form of collateral. In most cases, equipment or property, which normally reduces the risk involved for the lender, can act as security. Unsecured debt is simply an obligation that isn't collateralized. Therefore, nothing is liened against the debt, and rates of interest are normally higher in respect to heightening the risk.

Short-Term vs. Long-Term Debt:

Short-term debt must be paid back nominally in less than a year. Long-term debt is payable in more than one year's time. Most of it is guaranteed against the assets except for the case of bonds and mortgages.

Revolving vs. Installment Debt:

Revolving debt typically allows the business to borrow to a pre-determined level and to pay back as, and when, funds allow. Examples are credit lines and credit cards. On installment debt, periodic fixed payments are made for a specified period. Examples are term loans or equipment financing.

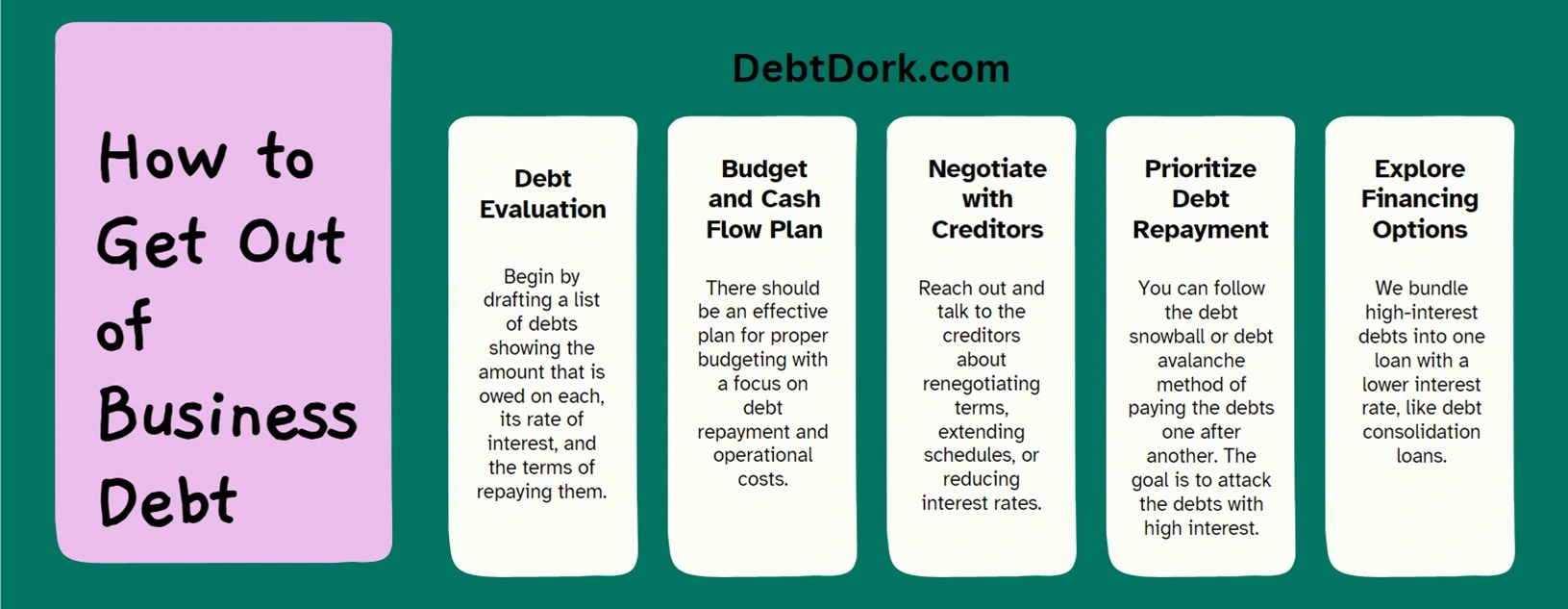

How to Get Out of Business Debt

Management and reduction of business debt must be undertaken in a very organized and meticulous manner. They include the following:

Debt Evaluation:

The entrepreneur should begin by drafting the list of debts showing the amount that is owed on each, its rate of interest, and the terms of repaying them.

Come Up with a Budget and Cash Flow Plan:

There should be an effective plan for proper budgeting that provides for a strong focus on debt repayment and the proper management of operational expenses. This cash flow is still tracked to ensure that money is available to pay all of the debts

Negotiate with Creditors

Reach out and talk to the creditors about renegotiating terms, extending schedules, or reducing interest rates.

Prioritize Debt Repayment

You can follow the debt snowball or debt avalanche method of paying the debts one after another. The goal is to attack the debts with high interest so that your total interest paid out is less and eventually your total interest payments can be avoided.

Explore Financing Options

We bundle high-interest debts into one loan with a lower interest rate, like debt consolidation loans. Explore financing to improve your cash flow like invoice factoring or asset-based lending.

Tips on Managing Business Debt

Some good ways of managing debt are:

Keep Accurate Financial Records:

Keep refreshing the financial statements to keep a tab on the debt levels and the financial health.

Avoid New Debt:

Avoid taking new debt unless it's strategic for growth or core operations.

Creation of a Contingency Fund

It will act as a sufficient back-up for meeting unforeseen expenses and thereby minimizing the compulsion to take recourse with new credit debt in times of financial emergency.

Professional Help and Advice

Seeking professional counseling from financial experts, or credit counselors, to devise a tailored strategy toward debt management and relief.

Types of Bankruptcy and Corresponding Results

Bankruptcy is a legally declared process under which businesses can either reorganize their debts or liquidate their assets according to court jurisdiction. Business bankruptcies usually vary, but most of them fall under the following categories:

Chapter 7 Bankruptcies:

The major problem of liquidating wealth to pay back debts; usually the result is the business closes This is where a company hardly stands a chance of recovery, but it has huge debts.

Chapter 11 Bankruptcies:

A type of bankruptcy that allows business reorganization of debt but still can operate under a court approved plan. It allows debt arrangement alteration and restructuring in the hopes to gain financial stability.

Bankruptcy Chapter 13 for Sole Proprietors:

The same as bankruptcy chapter 11, but it will allow sole proprietors to restructure personal and business debt.

Online Resources for Business Debt

Business Resources for Debt:

Government Agencies:Small Business Administration (SBA)

Information on managing debt, financing options U.S. Courts, Information on laws and procedures on bankruptcy.

Financial Institutions and Advisors: Banks and Credit Unions: Information on debt consolidation and financing options.

Financial Advisors / Consultants: Develop solutions custom to your needs and business specifics.

Online Tools and Communities:

Businesses basically harness debt management software, like Mint or QuickBooks, to trace expenses and manage budgets. Online forums and communities, like Reddit's r/smallbusiness, also provide support and advice on peer-driven debt management.

Managing business debt includes a lot of proactive planning, strategic processes, and access to helpful resources. Equipped with ideas about the types of debt, effective strategies to use, bankruptcy options, and online resources you can sail through tough financial times and get to long-term success.